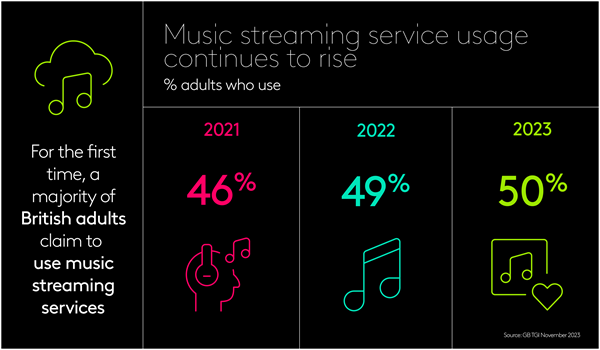

For the first time half of British adults claim to use music streaming services

Using music streaming services is now the norm among British consumers, with latest GB TGI data showing that 50% of adults claim to use such services – a figure that has continued to creep upwards in recent years.

Frequent use of music streaming services is also now the norm among users of such services. Indeed 53% of adults who use music streaming services claim to do so at least five days a week, with 39% claiming to use them every day.

Use of free vs subscription music streaming services is broadly similar, with around two-thirds of users claiming to use each.

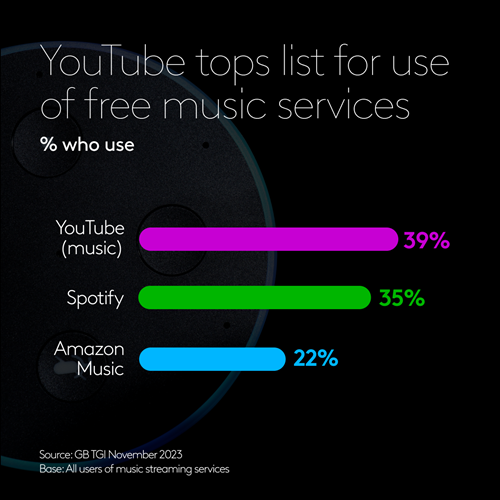

Industry giants Amazon and – particularly – Spotify dominate within both the free and the paid music subscription services, but both are trumped by YouTube when it comes to free music streaming.

There is plenty of crossover between paid and free streaming service users, with 55% of those using paid subscription services also claiming to use free services and 49% of free service users claiming to use subscription services.

There are few major demographic differences between paid and free music streaming service users, however paid users are 26% more likely than the average music streaming service user to be in the TGI Lifestage group ‘Nest Builders’ (aged 15-34, not married/living as a couple, do not live with relations), whereas free users are slightly less likely than the average music streaming service user to be in this group.

This can in part be explained by a reticence among this young cohort to avoid ads. Indeed, TGI shows ‘Nest Builders’ are 45% more likely than the average music streaming service user to say they are willing to pay a premium subscription on some websites/apps to stop having ads.

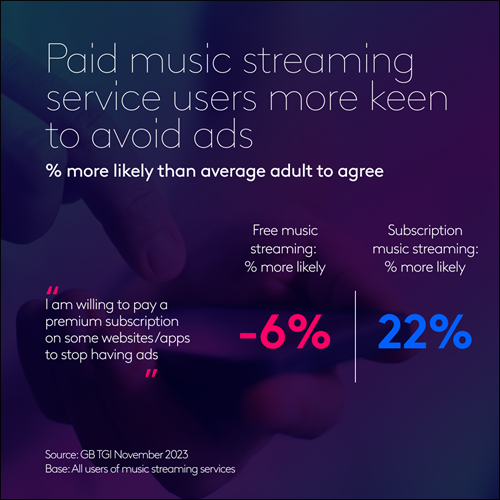

Similarly, those who pay for a music streaming subscription generally are significantly more likely to pay a premium on websites and apps to avoid ads, whilst users of free music streaming are less likely to do so.