Cinema affinity is strong for many consumers

The pandemic represented a tough period for cinemas, but since its end the medium has sought to re-establish its longstanding popularity with consumers. The cost of living crisis has not helped such efforts, yet many consumers today still have a profound attachment to cinema.

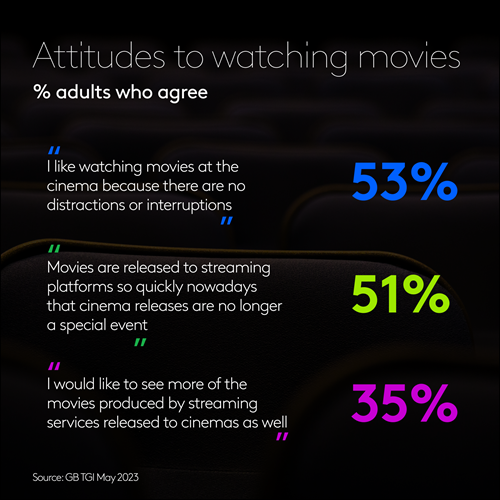

In our latest GB TGI monthly release for May we have new questions around cinema engagement which reveal how consumers are engaging with this medium and movies more generally today. This latest data shows that 60% of consumers agree that going to the cinema is a unique experience, whilst 53% of adults agree that they like watching movies at the cinema because there are no distractions or interruptions.

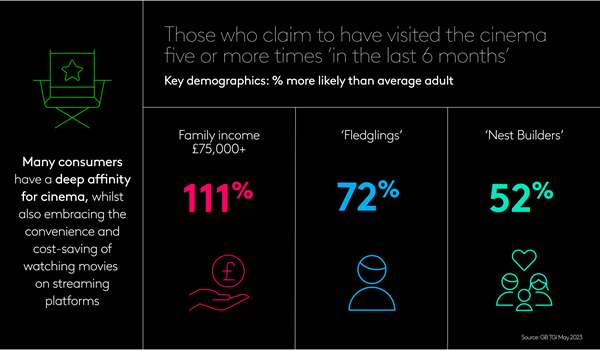

Beyond this, cinema has often had particularly sought-after audiences among marketers. For example, TGI reveals that those who claim to have visited the cinema five or more times ‘in the last six months’ are over twice as likely as the average adult to have a family income of £75,000+ and especially likely to be in the younger life stage groups without dependents to pay for, such as Fledglings (aged 15-34, not married/living as a couple, do not live with son or daughter, live with parents) and Nest Builders (aged 15-34, married/living as a couple, do not live with son/daughter).

However, cinema finds itself in the wake of the pandemic having to be mindful of the evolving media ecosystem, including how consumers are engaging with movies on video streaming platforms today. New TGI data reveals that 48% of adults today claim they prefer movies to be released to streaming services so they can watch them in the comfort of their own home. In addition – and no doubt reflecting in part the impact of the cost-of-living crisis – 60% of adults claim they would rather watch movies at home to save money.

There is also a sense amongst a considerable number of consumers that it is worth waiting for movies to be released on streaming services. Indeed, 51% of consumers agree that movies are released to streaming platforms so quickly nowadays that cinema releases are no longer a special event.

However, this sentiment works both ways insofar as a considerable proportion of consumers would like to see more content from streaming platforms shown at cinemas.

In terms of what would encourage consumers to visit the cinema more often, 75% of adults indicate cheaper tickets would help, whilst 25% feel promotions would be a solid prompt. Beyond this, for 23% of adults the locality of the cinema is a driver in prompting more frequent visits.

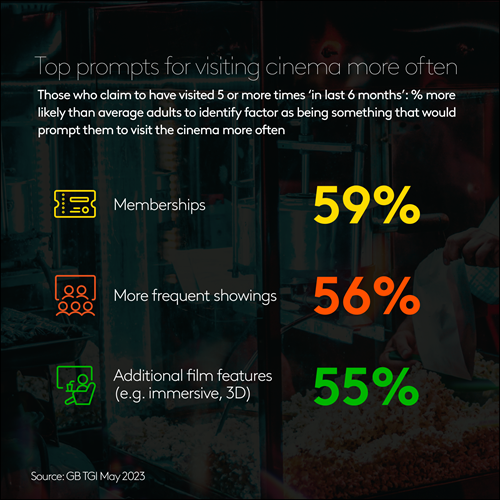

Among cinema’s most committed users – the core base of 5% of adults (2.9 million people) who claim to have visited the cinema five or more times in the last six months – cheaper tickets are no more of a draw than they are for the average adult.

Instead, these consumers are particularly likely compared to the average adult to identify cinema memberships, additional film features (e.g. immersive, 3D) and alternative seating (e.g. sofa or bed) as things that would encourage more frequent cinema-going.