Cost leads reasons of cancelling TV and video subscriptions

During the dark, cold evenings over the Christmas and new year period many people will have binge watched new series and films on TV and video streaming services.

But as the cost of living crisis continues to impact households across the country and many people find themselves needing to find savings after the cost of Christmas, there is a risk of video subscription services seeing a rise in the numbers of users considering cancelling their subscriptions in the early part of this year, especially with some such services recently raising subscription fees and/or introducing ads.

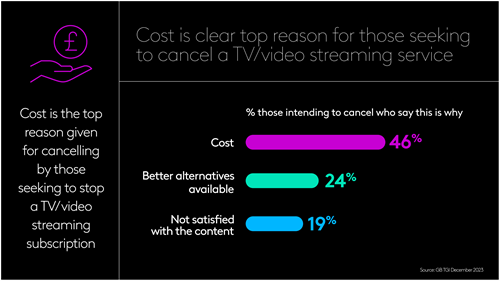

Indeed, monthly data released in our December GB TGI survey reveals that 11% of adults (6 million people) plan to cancel a TV/video streaming subscription in the next 6 months. By far the top reason is cost. However, also prominent among reasons for cancelling are better alternatives being available and dissatisfaction with content.

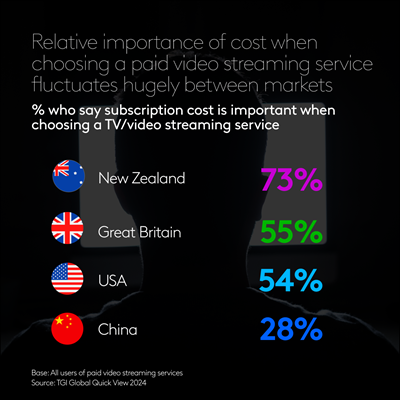

New data from our TGI Global Quick View study of consumer behaviour across 37 markets worldwide reveals British consumers to be somewhere in the middle, globally speaking, in terms of cost being an important factor when choosing a new paid video streaming service to subscribe to.

Britain ranks 17th of the 37 countries for cost being a key consideration. Globally, those in western markets tend to be more conscious of cost when it comes to paid video streaming.

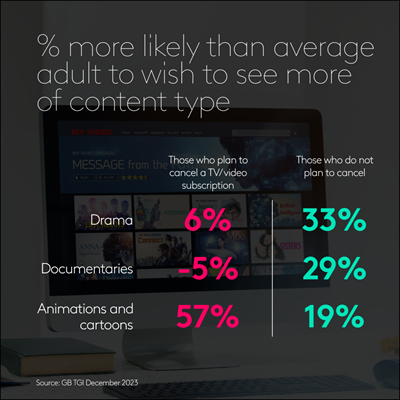

Focusing back on British consumers, there are some significant differences in the type of content those looking to cancel a TV/video streaming subscription service would like to see more of on such a service compared to those who do not plan to cancel.

Those who are not seeking to cancel are particularly keen on drama compared to the average adult, whereas those seeking to cancel are especially likely to have an affinity for animations and cartoons.

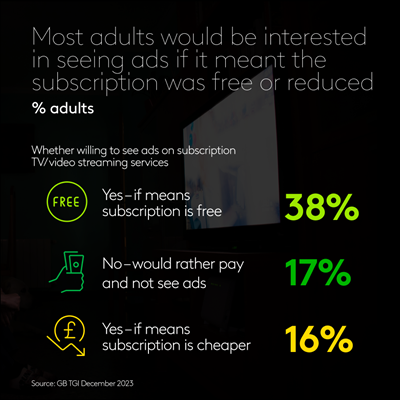

Netflix introduced partially ad funded pricing models to its subscription options around a year ago and Amazon is bringing in ads to their Prime Video service from next month, with the option to opt out by paying slightly more.

Consumers may prove largely accommodating of such practices up to a point, as most consumers claim they would be willing to see ads on TV/video subscription services if it means the service is free or cheaper. However, for most of these consumers (70%) the service would need to be free, whilst 30% would tolerate ads for cheaper subscription.