A growing proportion of credit card-owning adults are making minimum monthly payments

As the cost of living crisis squeezes spending, more consumers feel obliged to rely on credit facilities – however reluctantly – and take on more debt, including paying just the minimum amount each month on their credit card bill.

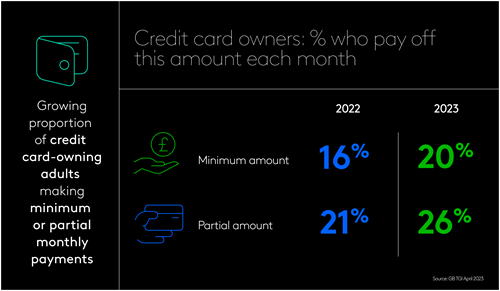

Indeed TGI reveals that the proportion of British adults with a credit card who claim to make the minimum payment each month has increased significantly in recent years. In 2018 14% claimed to do so, last year it was 16%, but today it is 20%. Those making a partial payment has also increased, up from 21% last year to 26% today.

Meanwhile the proportion of credit card owners claiming to make the full payment each month peaked two years ago at 80% during the pandemic as many saw their outgoings drop suddenly – before falling to 74% a year later in 2022.

Those who claim to make the minimum payment each month against their credit card are over twice as likely as the average adult to say that with a credit card they can buy the sort of things they couldn’t normally afford, with over half of them agreeing with this compared to 21% of those who make the full payment.

These minimum credit card balance payers are also 65% more likely than the average adult to agree that buy now, pay later services allow them to manage their budget better.

Compared to our European neighbours Brits for the most part tend to spend rather more on their credit cards. Amongst credit cards owners in western Europe, the average claimed monthly spend on such cards is just under €290 for those in Spain and in Germany – lower than the British figure of £371. Yet this in turn is lower than the average spend of €600 amongst credit card owners in France.

Those paying off the minimum amount on their credit cards is a group likely to be feeling financial pressure for a number of reasons even above and beyond rapidly rising prices.

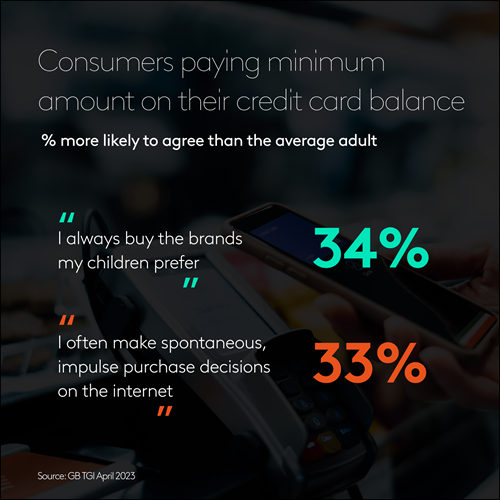

They are 42% more likely than the average adult to claim they tend to spend money without thinking and 34% more likely to say they always buy the brands their children prefer.

They are also 33% more likely to say they often make spontaneous, impulse purchase decisions on the internet.

Picking up on the buying for children point, those making the minimum credit card payment are especially likely to be in TGI Lifestage groups with children. They are 49% more likely to be ‘Playschool Parents’ (live with son/daughter and youngest child aged 0-4) and 46% more likely to be ‘Secondary School Parents’ (live with son/daughter and youngest child aged 11-15). The cost of raising a family explains in part their financial pressures and reliance on credit facilities.

When it comes to their media consumption, TGI shows that these minimum payers are particularly like to be amongst the heaviest consumers of video-on-demand.

Furthermore, they are 26% more likely to say they don’t mind sharing their personal data in order to get more personalised TV ads and 24% more likely to say they prefer to watch or stream shows that are recommended by streaming platforms.

They are also 20% more likely than the average adult to go online to find out more about a product or service seen on TV, whilst watching television.