As many consumers make new year’s resolutions to be more healthy, we explore how adults in Ireland today feel about their health and how this is evolving

One of the most common new year’s resolutions is the intention to lead a healthier lifestyle and/or lose weight. Resolutions often quickly fall by the wayside, but more revealing is to understand how the attitudes of Ireland’s consumers to health and wellbeing have evolved in recent years – especially with the considerable interruption of the pandemic to daily routines – and what opportunities these trends imply for marketers in the health and fitness space.

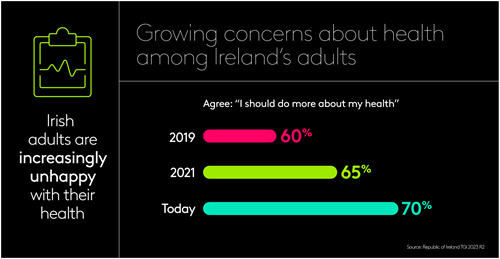

Latest data from our Republic of Ireland TGI survey reveals that the proportion of adults who feel that they should do more about their health has been rising in recent years. Standing at 60% in 2019 before the pandemic hit, it has risen by 10 percentage points in the past four years.

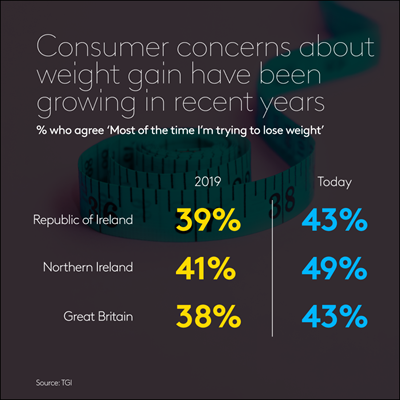

Related such health considerations have also seen a jump. The proportion of Irish consumers who agree that they are trying to lose weight most of the time has grown from 37% in 2018 to 43% today.

The Republic of Ireland is not unique in this regard. Indeed the proportion of adults in Britain who agree that most of the time they are trying to lose weight has also crept up in recent years.

What does this growing feeling towards needing to improve one’s health mean for engagement with health-related services such as gyms? Well in the Republic of Ireland the proportion of adults who claim to have visited either a private or public gym in the last 12 months has held up well despite the temporary closure of gyms during the pandemic.

Data from 2019 Republic of Ireland TGI reveals that 33% of adults claimed to have been to the gym in the past 12 months back then, whilst today the figure stands at a very similar 32% (1.3 million adults).

However, whilst overall gym attendance might be holding up well across the years, frequency is not. Indeed, the proportion of Irish gym goers who claim to go to the gym once a week or more has fallen from 58% in 2019 to 46% today. There is certainly scope therefore for those in the health and fitness industry to help turn burgeoning healthy intentions into practical actions.

Unlike in the Republic, in Northern Ireland and Great Britain claimed gym visiting as a whole has not recovered to where it was before the pandemic. For example, in Great Britain, 37% of adults claimed to visit a gym in 2019, but since the pandemic this has only recovered back to 27% of adults.

In the Republic of Ireland those who say they are seeking to lose weight most of the time are not significantly more likely than the average adult to say they visit a gym and the same is true for those who say they should do more about their health. There is thus scope for those in the health and fitness space to engage these consumers to turn their intentions of a healthier lifestyle into action.

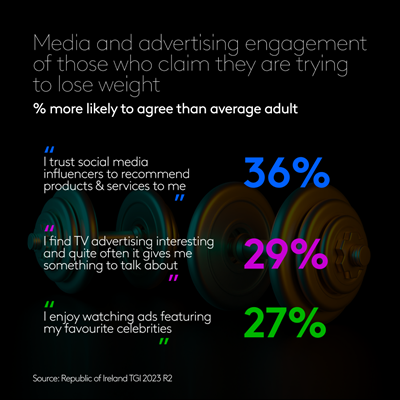

TGI reveals some of the media and ad formats that particularly engage those trying to lose weight, which could be leveraged in a campaign to entice this audience to improve their health. This includes engagement with influencers on social media and celebrities featuring in ads.